Leasing installment insurance for bicycle and electronics leasing

The leasing of bicycles and electronics is booming - whether as part of company bike models or due to the increasing demand for modern technology in companies (source). For many companies, leasing is the perfect way to use high-quality products flexibly and cost-effectively or to offer their employees a real benefit. But what happens when life takes unforeseen turns? When employees suddenly become parents or are made redundant? As a leasing company, how can you provide employers with the best service in such situations?

In this article, we show you which insurance module makes this possible and why it is indispensable for bicycle and electronics leasing.

What is leasing installment insurance?

Leasing contracts usually have a term of up to 3 years, but terms of 4 years are not uncommon. This is a long period during which many unforeseen things can happen. If the leasing installment can no longer be paid because, for example, salary conversion is no longer possible, companies are faced with a problem. This is because the leasing installment must still be paid to the lessor.

Salary conversion is no longer guaranteed, for example, in the event of parental leave, maternity leave, death, dismissal or temporary incapacity to work on the part of the employee. And this is exactly where leasing installment insurance comes into play.

If the leasing installment can no longer be paid, the insurer steps in for the lessee and the leasing company receives the rightful payment.

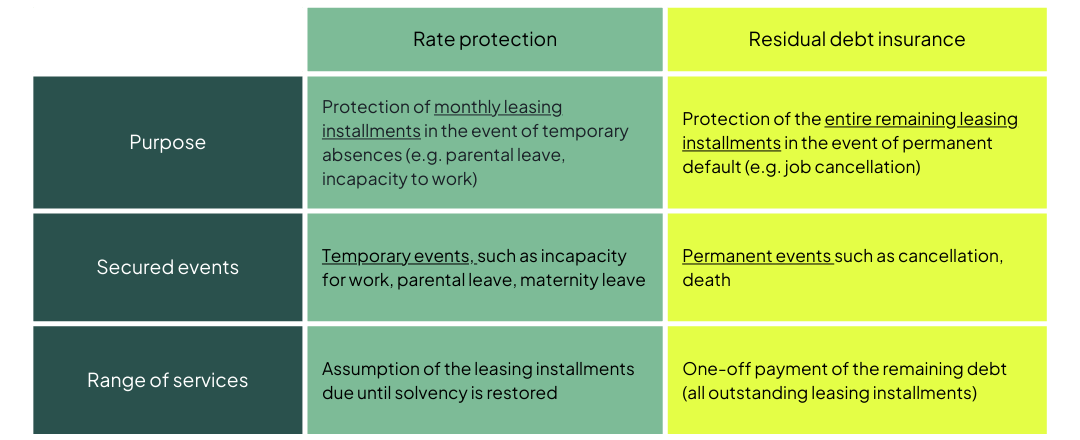

A distinction is made between the monthly installment and the residual debt. In the event of temporary incapacity to work, such as parental leave, the upcoming leasing installments must be covered until the lessee returns to work. If, for example, the contract is terminated, the entire remaining debt (all remaining installments) must be paid.

Ideally, of course, both scenarios are covered by the insurance.

The advantages of leasing installment insurance

The needs of end customers in the leasing sector are often diverse and individual. Many companies appreciate the flexibility of leasing contracts, but there is also an increased desire for sufficient cover for unforeseen events.

If salary conversion is no longer possible, a financial risk arises for companies, because even if the employee is no longer available, the leasing installments still have to be paid.

To reduce the fear of this financial risk, lessors can integrate the appropriate leasing installment insurance into their offer.

This is why leasing installment insurance is indispensable:

Added value for employers

For employers, leasing installment insurance is a decisive factor that makes leasing more attractive and secure. If a leasing installment can no longer be paid, the insurance will step in and save unplanned costs.

The risk of an installment issue is particularly high for large companies with many employees.

To ensure that the benefits of leasing are not cancelled or that time and money have to be invested in reserves, more and more companies are taking out leasing insurance when concluding a leasing contract.

Flexibility and individuality

Not all leasing installment insurance is the same. As with other insurance benefits, it is important to choose the right modules. From cover for maternity and parental leave to protection in the event of incapacity for work or cancellation - lessors decide together with their customers which scenarios are included in the offer.

Of course, the customers' idea of protection also goes beyond leasing installment insurance. However, this cover is an important addition to other essential modules such as fully comprehensive insurance with theft protection.

Billing and integration

An important aspect of leasing installment insurance is correct processing. There are already differences depending on the type of disability. The correct claims reporting and billing processes must be provided by the insurer.

Integrating these into existing, external processes can be a challenge. However, the digital solutions of an InsurTech enable insurance integration in which your processes continue to run smoothly.

Flexibility for individual requirements

It must be possible to provide contract concepts as the partner needs them and to adapt the contract construct to the respective case in a short space of time. Regardless of whether you are dealing with specific scenarios such as maternity leave or the combination of leasing installment insurance with other modules such as fully comprehensive cover or a letter of protection - you must retain control. This flexibility makes it possible to create an offer that exactly meets the needs of the respective customer.

Conclusion

Leasing installment insurance is an elementary component of modern leasing solutions for bicycles and electronics. It offers lessors the opportunity to minimise lessees' financial risks and thus guarantee them a high level of security.

Thanks to flexible modules, digital processes and seamless integration into existing offers, leasing installment insurance not only creates trust, but also efficiency. It ensures that leasing companies can strengthen their role as reliable partners.

Looking to the future, it is clear that in a growing market in which customers are demanding ever higher levels of security and service, the ability to provide customised and digitally supported insurance offerings will become a decisive competitive factor. Lessors who embark on this path at an early stage will position themselves as innovative and customer-orientated market players in the long term.

Are you looking for leasing installment insurance?

Let's work together to find the optimum insurance solution for you and your customers.