More is more: with the matching product protection

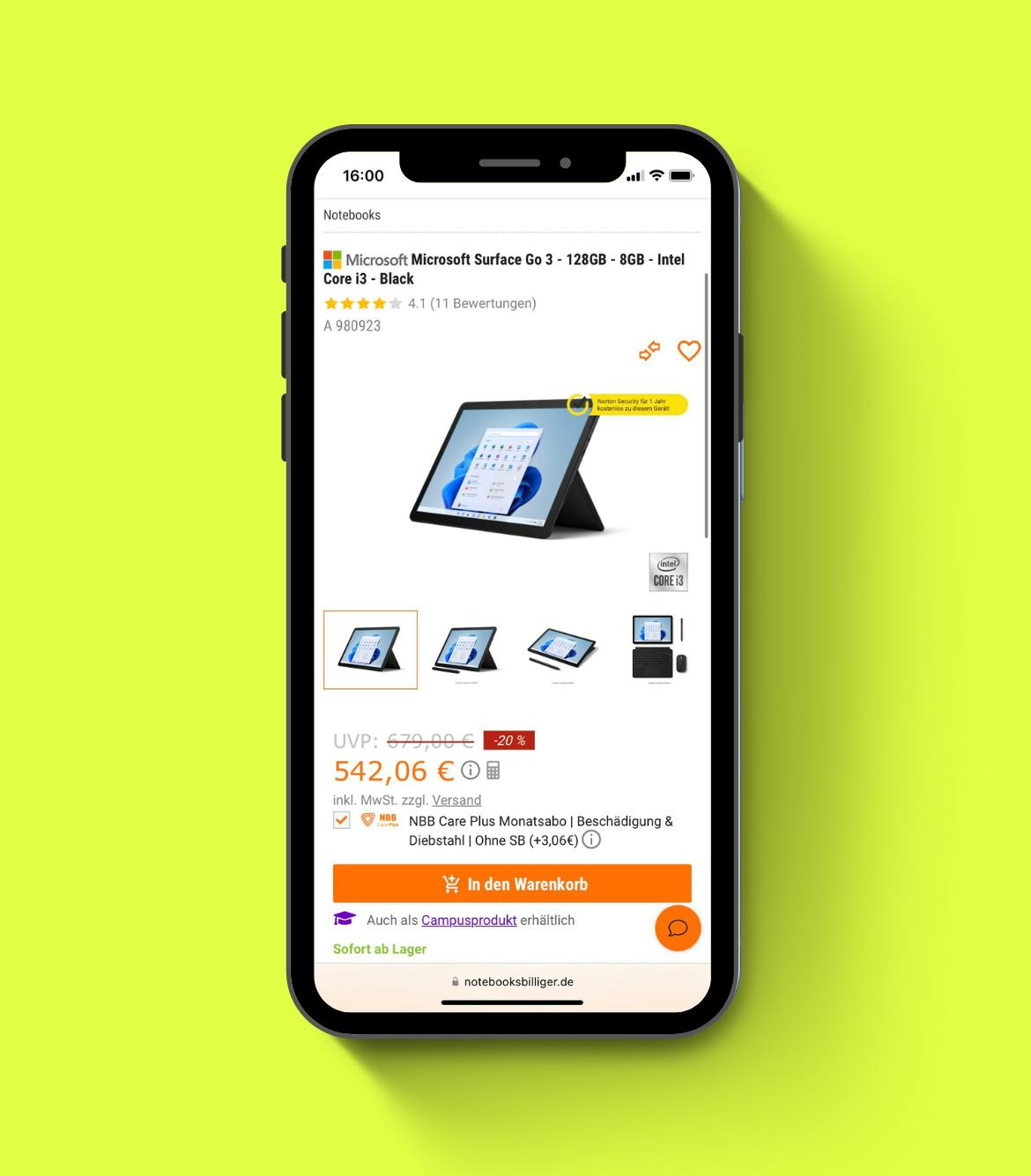

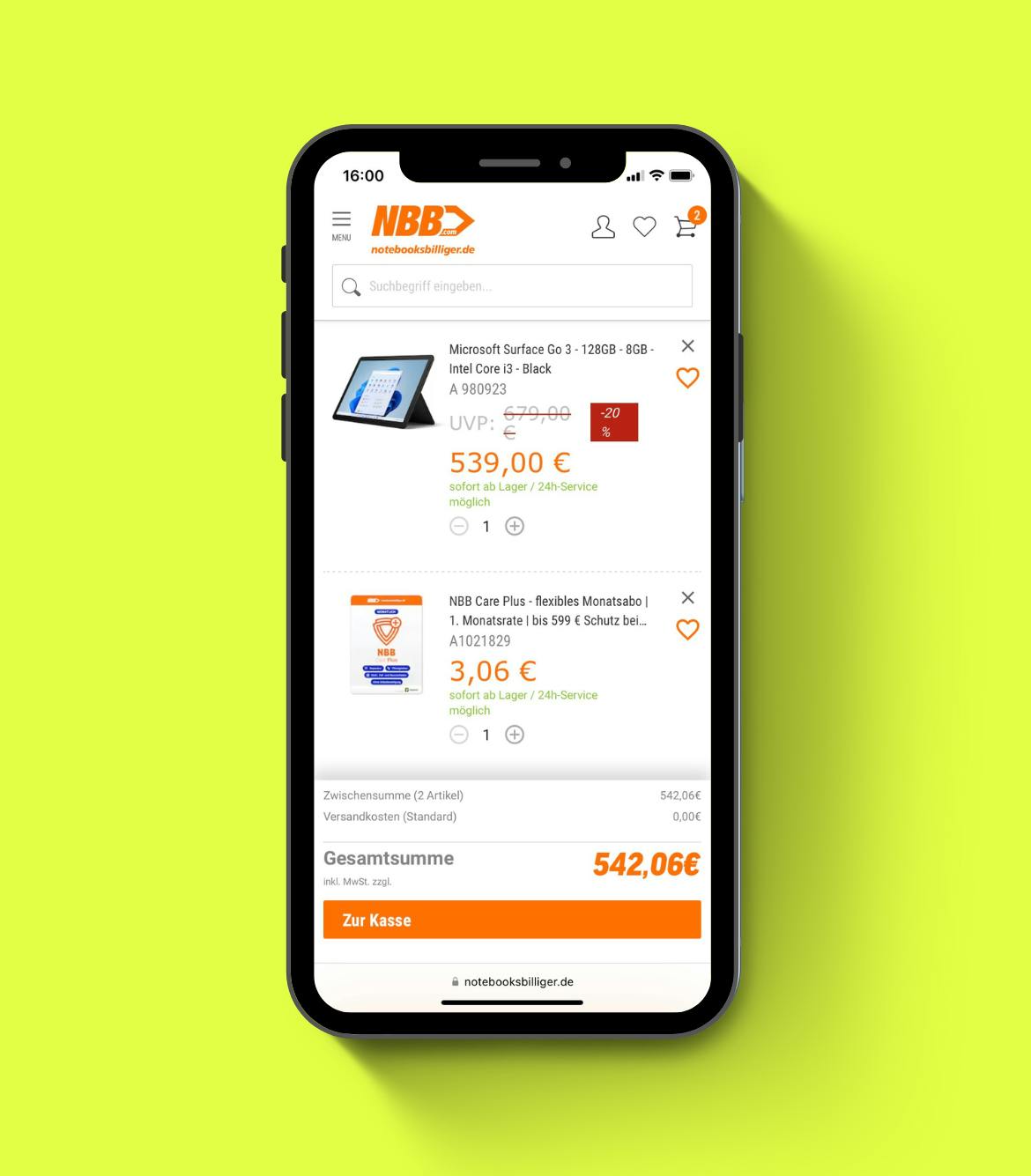

Today's customers want flexibility - flexible offers, flexible tariffs, flexible options, flexible payment methods. And yes, flexible add-ons like insurance, too. Seamlessly integrated at the point of sale, they offer your customers added value directly during their purchase and even beyond. Our partner notebooksbilliger.de wanted to offer their customers exactly this flexibility.

Diverse insurance offerings

Fabian Nösing, Marketing Director at notebooksbillger.de, on the cooperation with hepster:

"We place very high value on offering our customers a consistently flexible and customised buying experience. This also includes a comprehensive range of services. Accordingly, we are pleased to be able to offer our customers even more flexibility and strong protection for their electronics through the insurance offer with hepster."

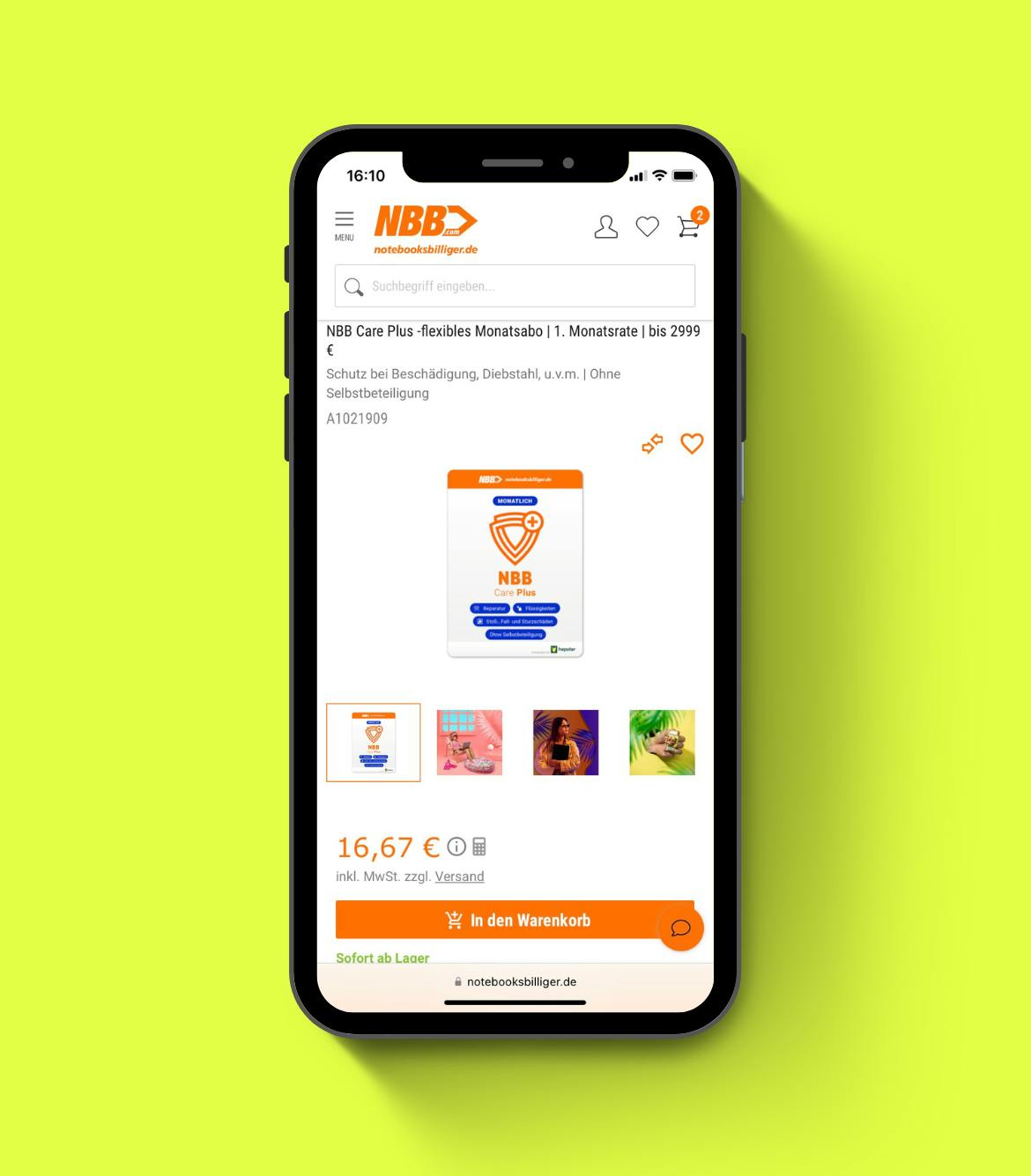

In addition to its flexible monthly subscription, notebooksbilliger.de is expanding its insurance offerings with two additional options. Customers can now choose between the monthly subscription NBB Care Plus, NBB Care & Repair for three years and NBB Extraschutz for two years.

Flexibility can be that simple.

A full 44 % of all customers now buy their electronics online - and notebooksbilliger.de is one of the leading providers in Germany. With the entire range of consumer electronics, smartwatches, laptops, cameras and more, customers are spoilt for choice. The range is as diverse as it is flexible because online retailers meet the needs of their customers exactly.

Find out more about how notebooksbilliger.de creates maximum flexibility for its customers by expanding its range of services and insurance.

Flexibility for NBB customers: NBB Care Plus

Benefit from strong customer loyalty and create a new revenue stream through our commission models. Your cost factor? Doesn't exist, because you, and we too, want to offer today's customers more flexibility without having to dig deep into their pockets.

01. A digital shell for electronic devices more

02. Maximum flexibility

03. Outrageously easy and affordable insurance

Say 'yes' to integrated insurance.

More than half of your customers have already taken out at least one insurance policy directly when buying a product. Add to this the high risk of electronic devices that are constantly with us and the increased susceptibility of damage to technical devices. Shake off your competition and discover individual insurance for your business model and the needs of your customers.