How can you increase customer lifetime value?

Which customers are valuable?

A customer who only buys something from you once has no lasting value for your company. Every business thrives on consumers who repeatedly generate new sales. It is precisely these customers who are characterised by a high Customer Lifetime Value (CLV for short). Roughly speaking, CLV represents the average value that a customer has for a company over the duration of the entire customer relationship.

Focusing on customers with a high CLV can pay off for your company in several ways. Many studies show how important it is to identify the most valuable customers and maintain the relationship with them. Strengthening the CLV, for example, helps to increase the retention rate. In practical terms, this means that a company is more successful in retaining its customers over a certain period of time.

Satisfied existing customers contribute significantly to a higher margin and therefore represent an important counterbalance to the high costs of acquiring new customers. Important: To optimise customer lifetime value, it is not enough to focus solely on the customer journey after the purchase. The relevant measures should already start at the point of purchase.

What measures can you use to increase customer value?

You can choose from a wide range of measures to increase customer value. It is important that they suit your business and that the costs and benefits are in a reasonable relationship to each other. A prior calculation is practically always useful. You could also ask yourself what your status quo looks like and what measures you are already using to identify untapped potential.

1. Cross-Selling

Generally speaking, customers who have already bought something from you are more likely to take advantage of further offers. Consumers love to get everything they need from one retailer. You can capitalise on this fact with cross-selling offers. They help customers to fill their shopping basket with additional products, thereby increasing their CLV.

Ideally, the add-on purchases are a useful addition to the main purchase. For example, if the customer has decided to buy a mobile phone, the matching mobile phone case could be considered as an additional offer. In bricks-and-mortar retail, add-on products are often located in the checkout area. In e-commerce, on the other hand, "customers also bought" suggestions are playing an increasingly important role. Algorithm-based recommendation systems are used here, which derive suitable purchase suggestions from the customer's purchasing behaviour.

2. Loyalty programmes

It is known that loyalty programmes have an increasing effect on customer lifetime value. They help to increase the number of interactions between a brand and its customers, which favours higher sales growth through repeat purchases. As a study by Brand Keys suggests, a seven per cent increase in brand loyalty can be enough to increase the CLV of each customer by 85 per cent. Participation in a loyalty programme is generally a good indicator of customer satisfaction.

To increase CLV, it is advisable to use targeted rewards. Ideally, you should create incentives at every point of the customer journey that encourage your customers to perform certain activities. These can be rewards, discounts, product samples or access to exclusive events, for example.

Loyal customers not only demonstrably spend more than new customers. They are also more willing to recommend a brand to others. According to a Motista study, around 70 per cent of customers with strong loyalty recommend brands to others. On average, this figure is only 45 per cent. For their part, recommendations can easily be linked to rewards, for example in the form of benefits or vouchers.

3. Exclusive memberships

Exclusive memberships point in a similar direction to loyalty programmes. For a small price, they allow customers to enjoy additional perks and benefits. Amazon is probably the best-known example of this approach. Those who are members of Amazon Prime can not only expect faster delivery, but also gain access to music and video streaming. It has been proven that satisfied Prime members increase their spending over time.

Of course, not every business is an Amazon, but even smaller businesses can benefit from a personalised customer experience. According to a study by Infosys, 74 per cent of customers are dissatisfied if the content on a website is not personalised. A membership can make the customer feel special. Discount benefits, earlier access to products, personalised product recommendations or exclusive offers are just some of the many options.

What each of these offers has in common is that they are based on the evaluation of previous customer activities as well as personal and demographic data. Personalised memberships give your company the chance to display the right content to the right target group at the right time. This increases the likelihood of page views, interactions, leads and, of course, (repeat) sales.

4. Service

Even before the customer journey begins with the purchase, customer service plays a huge role. Personal dialogue is still very important. Friendly and knowledgeable assistance from employees can hardly be overestimated when it comes to strengthening the customer relationship at an early stage. It is also becoming increasingly important for companies online to promote interaction with customers at every touchpoint. For example, flexible omnichannel interaction using multiple channels such as email, chatbot or telephone can contribute to this.

Technical aspects such as data collection, automation and AI are playing an increasingly important role in ensuring that the individual channels complement each other perfectly and that the customer never has the feeling of being left without a contact person. The personalisation and constant optimisation of the customer journey is a trend that is unlikely to lose any of its momentum in the coming years.

The world of customer service is not rigid, but is subject to constant change. Customer needs are also changing rapidly. Whether they need specific information, a solution or assistance, (potential) customers are less and less willing to wait a long time for answers. For companies, this development means that they should prioritise customer service. Transparency and quick feedback are crucial, especially when it comes to complaints, so that a customer journey does not end abruptly.

5. Versicherungen

Anyone thinking about particularly attractive purchases may not necessarily have insurance products in mind. Insurance is generally considered to be time-consuming and complicated, so it seems obvious for customers to focus on the actual product and its availability when making a purchase. This idea still lives on in many people's minds, even though the conditions have long since changed thanks to new technologies.

Thanks to InsurTechs, agonisingly long conversations about insurance products are being replaced by policies that are tailor-made for the respective product and partner. Providers are pursuing a fundamentally digital approach that enables them to combine data analyses, AI and even smart devices with the help of an API. Their holistic approach enables them to seamlessly integrate all touchpoints into one application.

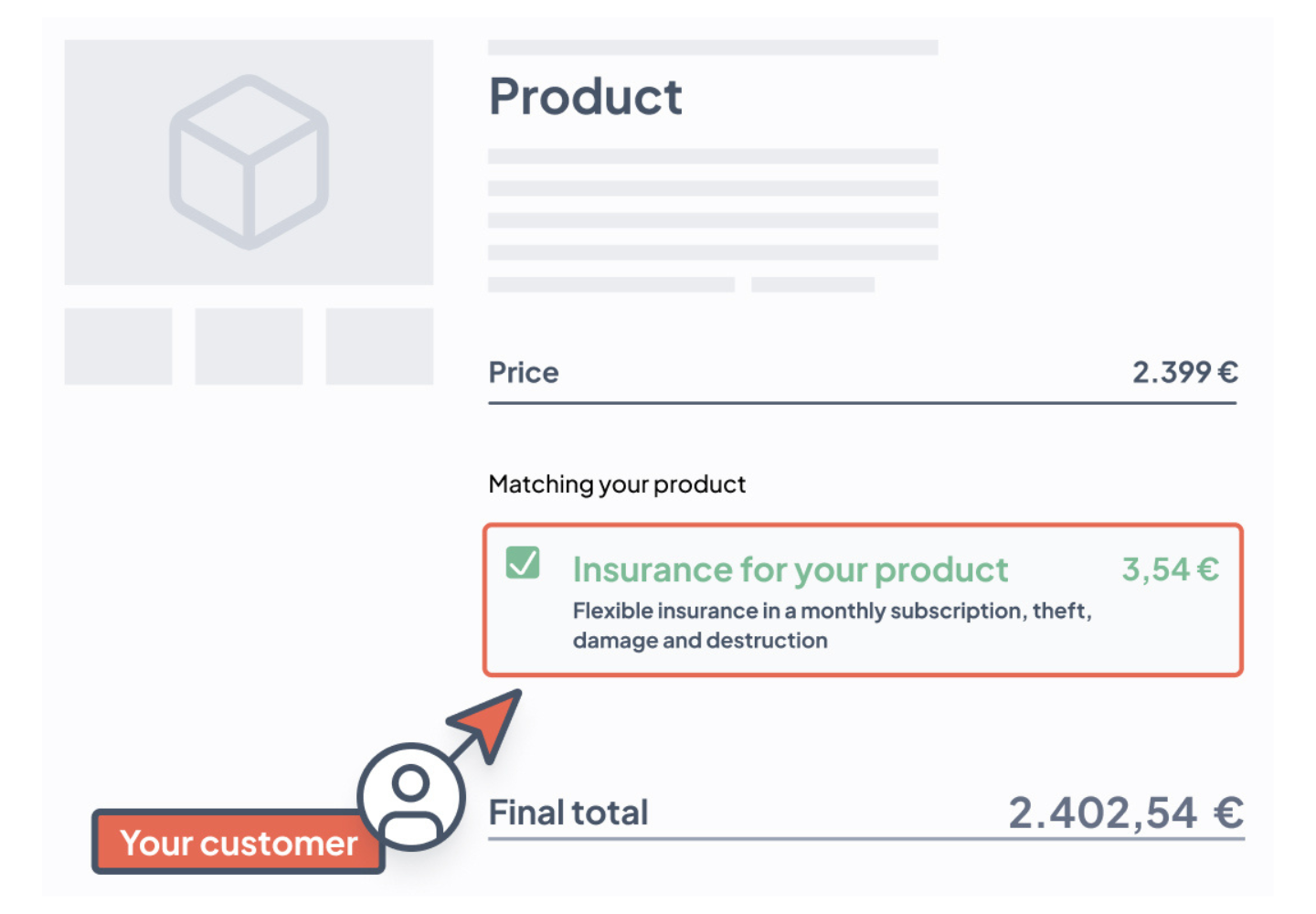

Digital insurance products have the potential to increase CLV. They can be taken out with just a few clicks using simple add-on extensions that complement the actual product. This simplicity can even win over customers who have previously shied away from insurance products. Even if the purchase was made a long time ago, the insurance service always maintains a connection to the company.

Integrated insurance products are also an interesting source of income for companies. Particularly in the case of high-priced products, corresponding additional offers can help to dispel customers' concerns. Quite a few consumers are happy to pay more to minimise their risks. However, insurance offers not only have potential as upselling measures. Through commission models, your company can generate additional income at the time of sale and subsequently in each insurance period (monthly or annually) and thus indirectly increase its margins. Good to know: There are no additional costs for you for the technical integration.

Conclusion

Acquiring new customers is very cost-intensive, which is why companies should try to utilise potential as much as possible from the very first customer contact. This applies not only to increasing sales, but also to aspects such as customer loyalty or the fulfilment of the service promise. All of the measures outlined above should be taken into consideration and understood as part of the customer journey right from the start.

Once the customer has bought from you for the first time, it is important to encourage them to make further purchases. In order to strengthen customer loyalty from the very first purchase, it is crucial to provide a holistic customer experience. If you don't start looking for new customers until months after the first sale, it could be too late.

If you manage to reach your customers 100 per cent right from the start, this will increase their willingness to engage with new information and offers. Once you have overcome the first hurdle, it is important to stay on the ball. An integrated insurance offer, for example, refers to the entire life of the product so that it helps to keep the company in people's minds.

Sources

https://www.latori.com/blogpost/customer-lifetime-value

https://www.moengage.com/blog/increasing-customer-lifetime-value-with-loyalty-programs/

https://www.retently.com/blog/increase-customer-lifetime-value/

https://datasolut.com/wiki/cross-selling/

https://www.zendesk.de/blog/insurtech-disruptors-teaching-industry-valuable-lesson-customer-experience/