Electronics and IT Leasing

Electronics Leasing is gaining importance

The digital world is evolving rapidly. Companies are constantly faced with the challenge of keeping up with technology. Especially in the field of electronics, the need for upgrades and innovations is limitless. However, the regular acquisition of hardware and expensive devices such as laptops or smartphones can quickly become a challenge to a company's liquidity. But there is an alternative that offers companies more financial security and flexibility: Electronics Leasing.

What many people know from cars is also becoming increasingly popular for IT equipment and electronic devices: leasing. In 2023, the IT leasing business grew by 3.6%.*

In the following, we explain why IT Leasing is so interesting, what differences exist compared to purchasing, and what role the right insurance plays.

Buying or leasing technical equipment?

Electronics leasing operates similarly to auto leasing, except that it involves electronic devices such as computers, laptops, printers, or coffee machines. A pre-agreed regular fee is paid for the use of these devices over a specified period. At the end of the contract, the devices are returned.

In contrast to purchasing, the company does not acquire ownership rights to the devices, but it reduces the initial financial burden since the full purchase price does not need to be paid upfront.

When purchasing, the company retains full control over the devices and can use them indefinitely. There is also the option to sell older devices to support the financing of new purchases. However, with leasing, it is advisable to regularly exchange the devices for more up-to-date models by entering into a new contract for an updated device at the end of the lease term. This ensures that the latest technology is always utilized without the need for regular high investments.

Advantages and Challenges

One notable benefit stems from the currency of the technology, a factor of great importance to businesses. When acquiring new hardware, a long-term usage cycle is necessary to make the investment profitable. However, given the rapid progress of technology, this timeframe is often not feasible. Leasing, on the other hand, allows the IT infrastructure to be cost-effectively kept up to date. This enables companies to consistently benefit from current technological developments without having to deal with high acquisition costs. A positive side effect of state-of-the-art technology is that employees are more motivated and productive.

Another plus point is predictability: By entering into a leasing agreement, companies have clear knowledge of their monthly costs. The burden is slight, predictable, and large one-time expenditures are eliminated.

Additionally, there are tax benefits, as lease payments are usually deductible as operating expenses, thus reducing the tax burden. Creditworthiness is also positively influenced. Thanks to predictable payments, the company remains liquid and does not need to take out loans that burden the balance sheet.

Of course, there are also disadvantages to leasing. For example, no ownership is acquired. The leased electronic devices are no longer available after the end of the contract term and cannot be sold or reused in areas with lower requirements. If there is an option for acquisition, the purchase price to be paid is often not economically viable due to the already paid installments. While entering into new contracts keeps the technology up to date, it also requires a new configuration and setup each time. Particularly with laptops and PCs, configuration can strain the capacities of the IT department and tie up resources. Additionally, employees may need an adjustment period to become familiar with the new devices or operating systems.

IT leasing and electronics leasing can be a top-notch financing alternative, especially for companies that value cutting-edge technology. However, it always remains a matter of balance to determine priorities, pursue goals, and allocate resources.

The importance of insuracnes in leasing

Electronic devices are particularly sensitive and therefore prone to damage. For example, if there is a failure due to fire, theft, fall, or simply user error, this is associated with high follow-up costs. Repair or replacement costs further increase the damage sum. The failure of a server or computer also disrupts business or private workflows.

In the event of an extended outage, million-dollar losses in revenue are even possible. The longer the outage lasts, the greater the financial damage. Therefore, it is extremely important to quickly and easily obtain a replacement so that business operations can return to normal as soon as possible.

An insurance policy integrated into the electronics leasing agreement is therefore of great importance to protect against potential risks. Insurance generally protects against unforeseen events that cause damage to the device, such as falls, liquid damage, or improper handling. The insurance covers the resulting damages and repair costs. With theft insurance, there is no need to fear being held liable for a stolen device, and a replacement device can be obtained without difficulty.

Customised leasing insurance packages at hepster

hepster offers a comprehensive package to protect electronic devices. The cornerstone is always fully comprehensive insurance including GAP cover, which protects against damage and theft. Optionally, modules with protection against wear and even rate protection can be added.

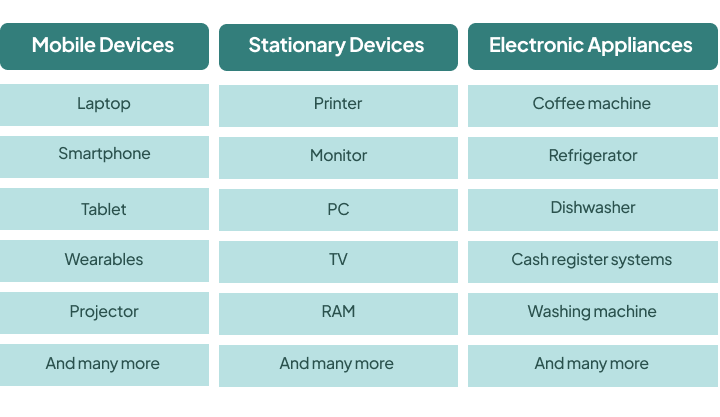

hepster's flexible insurance package can be put together for a variety of devices:

The following and other risks are covered by hepster insurance for IT leasing and electronics leasing:

- Fall and breakage damage

- Liquid damage

- Short circuit & fire

- Operation error

- Theft

- Battery and display damage

- Installment default

Through our unique product portfolio, we are capable of offering tailored solutions precisely aligned with the needs of both employers and employees. Additionally, we provide a variety of supplementary services. For instance, if there are concerns about being left solely responsible for lease payments in the event of an employee's prolonged inability to work, we have a suitable solution readily available:

Our rate protection intervenes in case lease payments cannot be met due to termination, parental leave, maternity leave, illness, or death. Consequently, neither the lessee nor the lessor bear the financial consequences. Consider a scenario where an individual within the company takes parental leave and no longer requires the laptop for the following months or even years. In such a situation, despite the ongoing contract term, the company is not burdened with the costs of unused hardware, thanks to our rate protection.

Electronics Leasing: Save more than purchase costs

Electronic leasing has proven to be a cost-effective and flexible solution for businesses in the modern corporate world. Apart from the obvious benefits of preserving liquidity and regularly updating technological equipment, there are numerous other reasons why companies opt for this model.

A crucial aspect of electronic leasing is the ability to protect oneself from unexpected costs. With the right insurance package, companies can ensure that their leased devices are optimally secured. This insurance can cover various incidents, from hardware malfunctions to classic issues like liquid damage, theft, or vandalism. As a result, companies remain protected from unforeseen expenses that could otherwise jeopardize their financial stability.

Furthermore, electronic leasing offers companies the flexibility to quickly adapt to evolving technological demands. In a constantly evolving IT landscape, staying up-to-date with technology is crucial for remaining competitive. Through leasing, companies can ensure they have access to the latest and most powerful devices at all times without making significant investments in purchasing new equipment. This flexibility enables companies to agilely respond to changes and drive innovation.

Another important aspect of electronic leasing is the opportunity to optimize service and support for the leased devices. Through specialized service agreements, companies can ensure that any issues are promptly and efficiently addressed. This minimizes downtime and helps ensure that business processes run smoothly.

Overall, electronic leasing is an attractive option for companies of all sizes looking to optimize their technological infrastructure while preserving financial flexibility. By selecting the right insurance package, having flexibility in device selection, and optimizing service and support, companies can ensure they fully leverage the benefits of electronic leasing and strengthen their competitiveness.

Sources